The Excel PMT function calculates payments for a loan based on constant payments and a constant interest rate. To calculate the payment amounts, the following variables must be known:

- The interest rate

- The total number of payment periods

- The value of all loan payments now (the loan principal).

It is categorized with the financial functions within the Excel Function Library.

Download your free PMT function Excel practice file!

Use this free PMT function Excel file to practice along with the tutorial.

PMT function Excel

Return value

The output from this function is the amount that the borrower can expect to pay at each interval (usually monthly), represented as a negative number (e.g., -$1,765.50). Of course, this does not account for taxes or fees which may be associated with your institution or locality.

Syntax

The syntax of the Excel PMT function is:

=PMT(rate, nper, pv, [fv], [type])

The first three arguments are required, while the two in square brackets are optional.

|

Argument |

Definition |

|---|---|

|

rate |

the interest rate for the loan. |

|

nper |

the number of payment periods for the loan. |

|

pv |

the present value, or loan principal. |

|

fv (optional) |

the future value or cash balance you want to attain after the last payment is made. If omitted, fv is assumed to be 0 (zero), that is, the future value of the loan is 0. |

|

type (optional) |

indicates when payments are due. Type 0 means payments are due at the end of each period. Type 1 means payments are due at the beginning of the period. If type is omitted, zero is assumed. |

Arguments may be entered directly into the formula, or may be cell references containing the values.

Required arguments

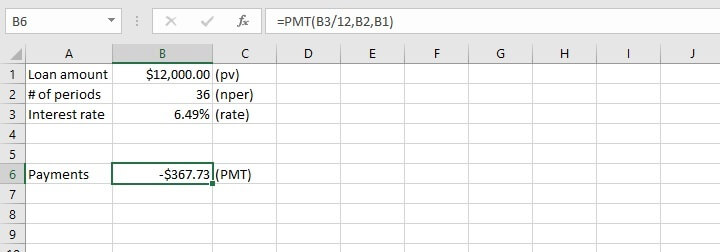

The first example will look at how to use the PMT function with the three required arguments only.

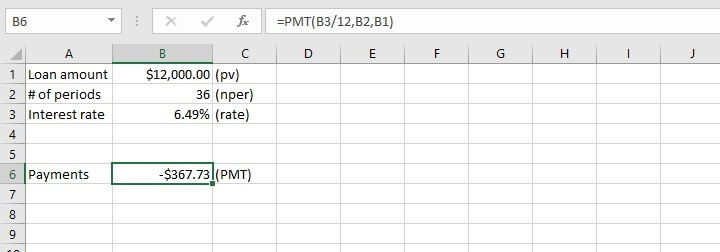

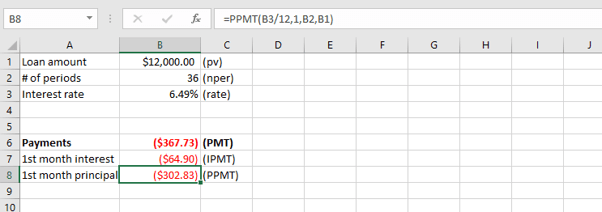

To get a car loan of $12,000 at an annual interest rate of 6.49% over three years, the PMT function can be applied quite easily.

Secondly, the interest rate is entered in the PMT formula in cell B6 as the annual interest rate divided by 12. This is because since the loan period has been broken down into monthly payments, the interest rate must also be entered as a monthly rate in the loan calculator. Otherwise, it would seem that the interest of 6.49% is being applied to the loan every month.

Since no optional arguments were entered, the assumption is that at the end of 36 months, if all payments are made as agreed, then the loan is considered paid off and has no further cash value. It is also assumed that payments are due at the end of each one-month period.

Finally, as mentioned before, the return value is shown as a negative value since it is money being paid by the borrower.

In cases where a deposit is required, the present value is calculated as the loan amount less the deposit. Therefore, only the amount that is actually disbursed is used in the PMT calculator.

Let’s now learn how to apply the two optional arguments in the Excel PMT function.

Future value

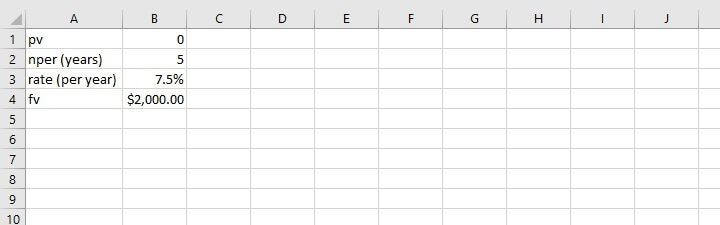

The future value (fv) argument is typically used to calculate the amount of money to be deposited at each interval to achieve a certain return at the end of an investment period. The interest rate must be known.

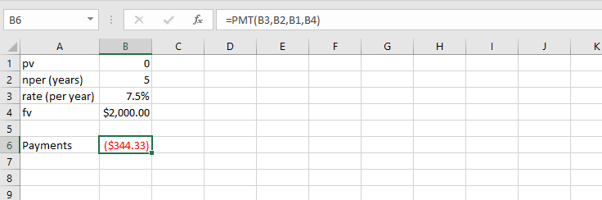

For instance, if an interest rate of 7.5% is offered on 5-year investments, and we would like to have $2,000 at the end of five years, how much would we need to invest each year?

=PMT(B3,B2,B1,B4)

Payment type

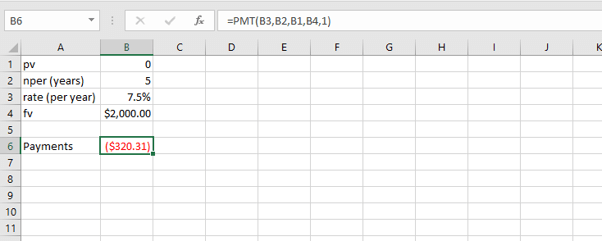

What if payments are expected at the beginning of each year rather than at the end? Then we would type 1 as the last argument of the formula. When payments are made at the end of a period, we can either type 0, or omit that argument.

=PMT(B3,B2,B1,B4,1)

IPMT, PPMT, and PV functions

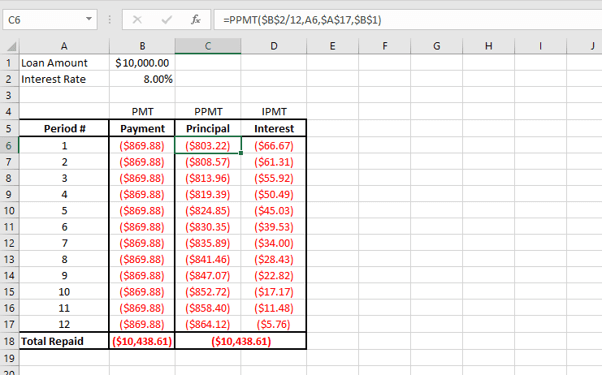

Closely related to PMT are IPMT, PPMT, and PV functions. The IPMT and PMT functions are used to calculate interest and capital repayments for each repayment period. They help us understand how the proportions of interest and capital repayments change over the life of the loan.

The PV function is used as a reverse calculator for calculating present value.

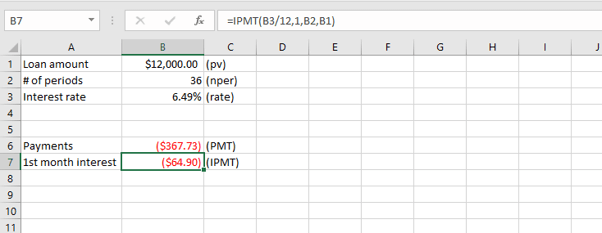

IPMT function

The syntax of the IPMT function is:

=IPMT(rate, per, nper, pv, [fv], [type])

Let’s return to our car loan scenario.

=IPMT(B3/12,1,B2,B1)

PPMT function

The PPMT function can be considered the opposite of the IPMT. It is used to calculate the principal portion of a loan payment. The syntax of the PPMT function is:

=PPMT(rate, per, nper, pv, [fv], [type])

In our previous example, we could have subtracted the interest amount from the loan payment amount, or we can use the PPMT function.

=PPMT(B3/12,1,B2,B1)

The chart visually illustrates the increasing proportion of the repayments being applied toward the principal amount, and the related decrease applied to interest.

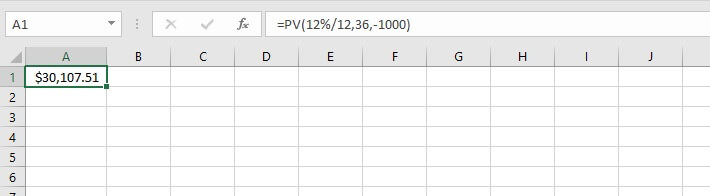

PV function

Conversely, if the borrower knows how much they can afford to pay per period, then the PV function can be used to calculate the present value of their payments as a lump sum. In other words, the value of the loan they can get now.

The syntax is:

=PV(rate, nper, pmt, [fv], [type])

If the bank’s interest rate is 12% for a 3-year loan and the borrower is willing to pay $1,000 per month, the PV can be calculated. Let’s enter the values directly into the formula.

=PV(12%/12,36,-1000)

Note that the pmt argument is entered as a negative number (-1000).

Learn more

Now that you’ve seen how Excel can demystify this seemingly complex topic, why not download our practice exercise and experiment with some scenarios of your own?

Then, you can really roll your sleeves up by checking out our course library for even more Excel tools to enhance your workflow. You can start with the Microsoft Excel - Basic and Advanced course today!

Level up your Excel skills

Become a certified Excel ninja with GoSkills bite-sized courses

Start free trial